Payday lenders have been having a tough time in Garland, Texas.

Their storefronts have closed, their gaudy signs spray-painted over in black. In recent months, about a third have left the city of 230,000, situated 18 miles northeast of Dallas.

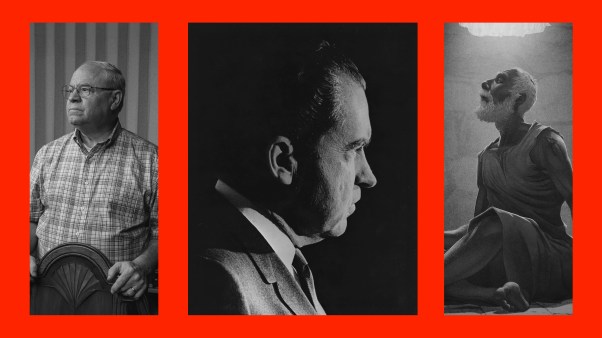

Nobody could be more delighted at their demise than Keith Stewart, senior pastor of Springcreek, Garland’s largest church. Springcreek will not tolerate what Stewart calls the “predatory loan business.” Stewart estimates something like a third of his congregation of 1,700 have been put through the wringer after they (or their family members) secured loans with interest rates easily within the range of 200 to 500 percent.

But Stewart says the interest rates are only part of the problem. Loan origination fees and penalty fees for non-payment are among the crippling burdens imposed on borrowers. And if a poor unfortunate really can’t repay, lenders are more than happy to offer new loans with a raft of new fees, forcing clients further and further into a debt trap that quickly proves impossible to escape. As Stewart put it: “They take a desperate person and make them destitute.”

The Infinitely Expensive Tuba

The case of Springcreek church member Gordon Martinez is fairly typical. The former high school teacher is educated and articulate, but even he was bamboozled by a loan industry that is eager to stress how quickly they can give cash, but slow to explain the dire consequences downstream.

The descent into debt hell started when Martinez, an accomplished musician, pawned his $8,000 tuba at a Cash America store to secure a $500 loan to help him pay rent. The father of three had abandoned teaching to take up a new position in sales. He was still establishing himself, and inevitably, money was tight. Martinez anticipated he’d need the $500 to cover him for just a few months. He was badly mistaken.

After a few fairly typical but financially sapping life events took their toll on his family, a friend told Martinez about Cash Store, located just up the road from the kids’ school. He took out another loan. Then he took out more, with other lenders to cover the original loans. They were not spectacular sums—typically $200 to $300—but nevertheless, ever-escalating repayments were being drained directly from his bank account.

He found himself forced to choose between feeding his children or closing his bank account and defaulting. He chose the latter.

The pain did not end. Now Martinez was obliged to go to yet other payday lenders to cash his checks—naturally, for a fee. The stress prompted the collapse of his marriage. His wife and children moved to another state.

Even though he was doing better in his sales job, it made no difference. He was destitute. “It got to the point where I had all my worldly possessions in two plastic tubs, and I responded to a Craigslist ad to live on a couch in a one-room studio apartment,” he said.

And the tuba? Altogether, Martinez paid $3,700 to repay the $500 loan and try to recover his beloved tuba. He never succeeded.

“50 People from Springcreek Walk In”

Sometime around when things were at their bleakest, Martinez had the good fortune to end up at Springcreek, washed-up and broke. Fortunately, the church has a big heart for those in Martinez’s position. Help, both spiritual and material, flowed generously.

Martinez especially remembers a church-organized “garage sale” event where church members were invited to bring along what they did not need. But no money changed hands; instead, those who were struggling could take what they wanted. Martinez picked up much-needed clothes, shoes, and kitchen utensils. The church also became Martinez’s spiritual home. He was baptized by the associate pastor in 2013.

All the same, in Stewart’s eyes, the church showing compassion and offering spiritual nurturing was not enough. There also had to be justice.

It rankled Stewart to find the church bailing somebody out to repay and enrich lenders, whose only contribution to the problem was to make things considerably worse. And it was not just distaste for the practices of the lending industry that drove him: as he saw it, it was a direct affront to the Word of God.

“In Scripture, there are many legitimate ways to make money, but the illegitimate way is to make money by impoverishing others, and this is exactly what the predatory loan industry does,” he said.

For a biblical example, take Jesus’ indictment of the Pharisees for “devour[ing] widows’ houses” (Mark 12:40). The Pharisees used somebody else’s dire circumstances—the loss of the primary breadwinner—as an opportunity to enrich themselves.

To Stewart, modern-day lenders are little different. “It’s wrong to see another’s desperation as the chance to put them into an agreement that will all but guarantee that what little they have left will soon be yours,” he said. “Just read Isaiah 58 or the Book of James, chapter five.”

Of course, expressing indignation about an iniquitous practice is one thing; being able to do anything about it is quite another. Fortunately, in recent years, municipalities in Texas have become heartily sick of the predatory loan industry.

It’s not hard to see why. A 2013 study conducted by the Insight Center for Community Economic Development showed payday lending drained more than $95 million from the Texas economy and led to a net loss of more than 1,300 jobs. In 2014, Texas auto-title loans, where car titles are used as collateral, contributed to more than 44,000 cars being repossessed—leaving many of their former owners unable to get to work.

Ann Baddour, director of the Fair Financial Services Project at Texas Appleseed—a non-profit that uses volunteer lawyers to promote social justice in Texas—says payday and auto- title operations are effectively subsidized by tax dollars and charitable contributions. She says that very often, when families hit a crisis, the assistance they receive from state agencies and churches goes to servicing loans rather than paying essentials like rent. She cites a survey released in 2011, which showed that 76 percent of Catholic charities’ clients who were in trouble with payday or auto-title loans also received a public benefit.

With little help from the state legislature, cities waking up to the harm being done to their communities began imposing tough new ordinances of their own, trying to curb the more egregious lending practices.

Stewart got tipped off that Garland was about to consider a toothless alternative proposed by the lending industry, and he knew it was time to act. When Garland’s city council came to debate the issue, dozens of Springcreek church members crowded into the chamber to make their views known.

Stewart chuckles at the recollection: “There were nine items on the agenda that evening. There were about two or three people to speak on every agenda item, and we had 50 people from Springcreek walk in. So all of a sudden the city council takes notice.”

When it came time to discuss the lending issue, Springcreek members—one after another—stood up to relate their bruising experiences at the hands of lenders. By the time it came to the vote, the industry-sponsored legislation didn’t stand a chance. Councilors unanimously voted for the much tougher ordinance, known as the Texas Municipal League Model Payday Ordinance.

A few weeks after the council meeting, Stewart bumped into Garland’s mayor at a local café. The mayor admitted Springcreek’s presence had stiffened his resolve on the whole question, and he vowed to lobby harder to get similar legislation passed at state level.

State-wide legislation would certainly help. When regulations tighten in one city, predatory lenders simply shut up shop and move to the next. Many swooped into Garland when a tough ordinance was passed in Dallas. Now that Garland has its own ordinance, lenders have simply moved again to other nearby cities.

But it’s an uphill struggle to get the state to act. According to Texans for Public Justice—an Austin-based political watchdog—state politicians are pocketing millions of dollars in predatory-lender contributions. According to their “Lobby Watch” report, the 2014 election cycle saw predatory lenders spend almost $2.5 million in contributions, with the governor, lieutenant governor, and attorney general among those who benefited.

But while things may be stuck at state level, Springcreek is not standing still. Stewart is talking to other pastors in nearby cities, helping them be an effective voice for the same changes that have been seen in Garland. He also has presented testimony to the Consumer Financial Protection Bureau on the theology of debt. The CFPB is currently drafting new rules that would end payday debt traps by requiring lenders to take similar measures to the Texas Municipal League Ordinance. The draft rules are expected to be released in April 2016, followed by public hearings.

Stewart says there are encouraging signs the new rules will have real teeth, but warns they are likely to be bitterly contested by the lending industry.

Fighting for Transformation

It might seem odd that a pastor in the conservative South, which might tend to resent any kind of government regulation, should be such a fierce advocate for it. Stewart says he’s been able to forestall any possible backlash from his congregation by forcefully making the point that God’s Word underscores what an evil predatory lending is.

“If they don’t see that the Bible would say this kind of practice is evil,” he said, “then I’m not going to get them to rally, because the honest truth is Fox News could potentially speak into their life more than I do.

“The gospel is bigger than personal salvation,” he adds. “God wants transformation of all systems and structures affected by sin.”

In testimony to the CFPB, Stewart illustrated his point by highlighting the children of Israel’s deliverance from Egypt. From Mt. Sinai onward, God begins to lay down in law what would characterize this new nation. Foundational to this new covenant was the demand that they would never do to others what was done to them. God’s laws made abundant protections for borrowers, especially when people were vulnerable. There are extensive regulations regarding interest, collateral, fairness, forgiveness of debt, and return of essential assets. To protect the people, God codified all of this into law.

Joining Stewart in testifying before the CFPB was Gordon Martinez. These days, he is a financial coach for Springcreek, helping people avoid the mistakes he made, and he is part of Springcreek’s justice team, urging councils in other cities to pass ordinances like Garland’s. He is also the secretary for Faith in Texas, a multiracial faith movement for social justice. Less than a year ago, he says, he would have felt too ashamed to talk about his experiences.

“Satan was telling me, ‘You’re a bad person for having gone down this path: you need to suffer for it,’” he said.

Today, however, he—and Springcreek—are fighting it.