Well over a half million pastors, church staff members, and ministry employees kept their jobs and continued serving their communities during the pandemic thanks to Paycheck Protection Program (PPP) loans, according to a list released last week.

As part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed in March, the government offered grants to cover payroll costs for employers, including religious organizations, as a way to keep the economy going and reduce layoffs.

It was the first time the US government had offered to cover the salaries of clergy and ministry workers as part of a stimulus. Some critics—including within the church—discouraged Christian organizations from accepting government funds due to concerns over church-state separation, while others saw it as a way churches and charities to continue to meet community needs during the pandemic.

A list released Wednesday by the Small Business Administration (SBA) showed that at least 11,500 Christian organizations took advantage of the opportunity and received loans of $150,000 or more.

The list was culled based on a keyword search of terminology including church, Christian, Catholic, and diocese, so the totals do not include ministries without Christian wording in their names or those that received smaller loans. More than 80 percent of the 5 million US employers that were granted PPP loans took in less than $150,000, according to the Associated Press, and weren’t included in the recent data.

Through the program, companies and organizations with fewer than 500 employees could request up to two and a half months of payroll costs (excluding salaries above $100,000) to offset the economic hit of the coronavirus shutdowns. Most churches and ministries on the list fell in the $150,000 to $300,000 range. Using the federal funds, the average church retained about 60 jobs.

A few megachurches and denominations ranked among the largest stimulus loan amounts, taking loans of over $5 million. They include Willow Creek Church in Chicago, which preserved 353 jobs, and Life.Church in Edmond, Oklahoma, which kept 451 jobs.

The stimulus loans do not need to be repaid if used for eligible payroll and operations expenses.

On the SBA list of recipients of $150,000 or more, 7,009 had the word “church” in their name.

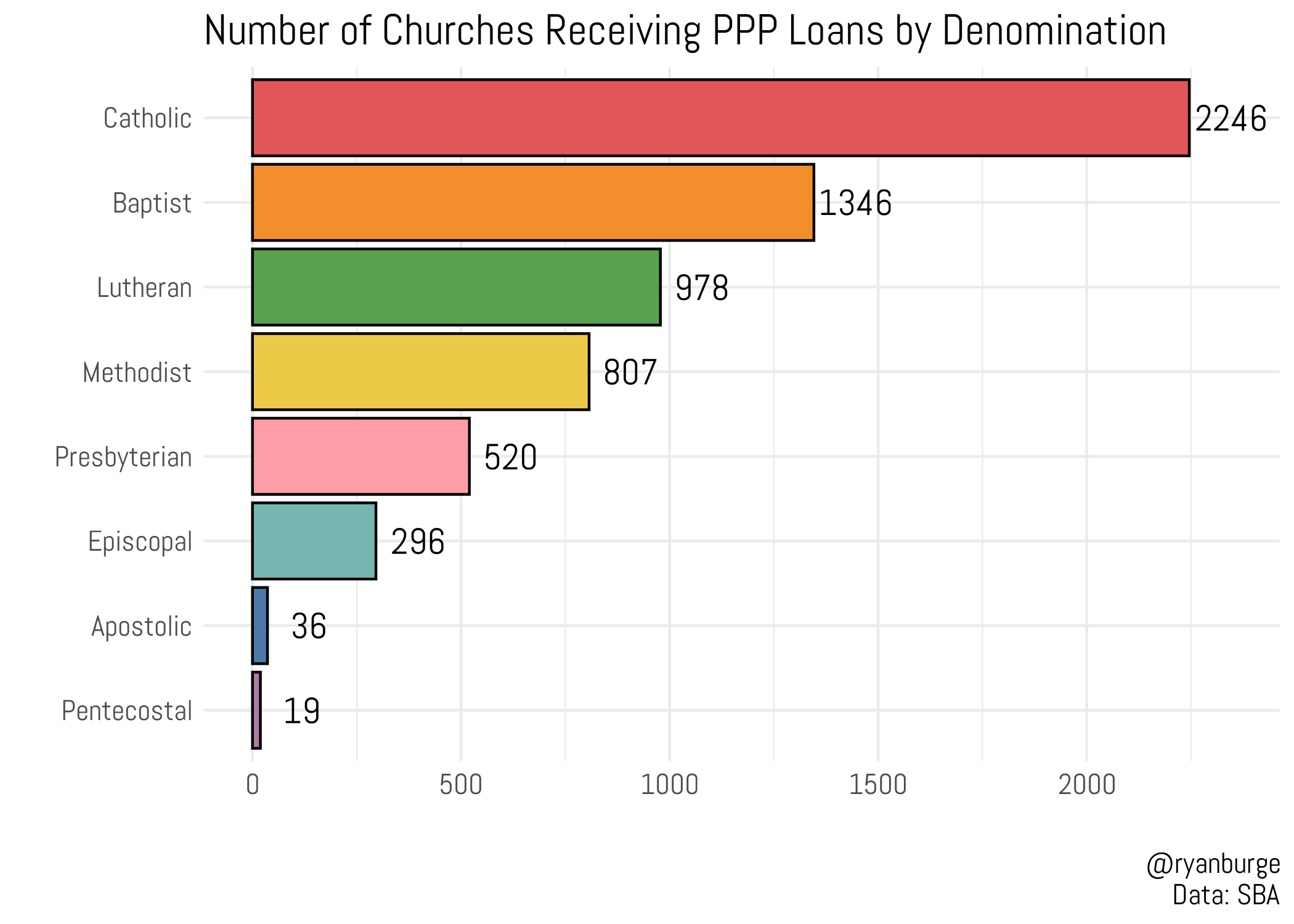

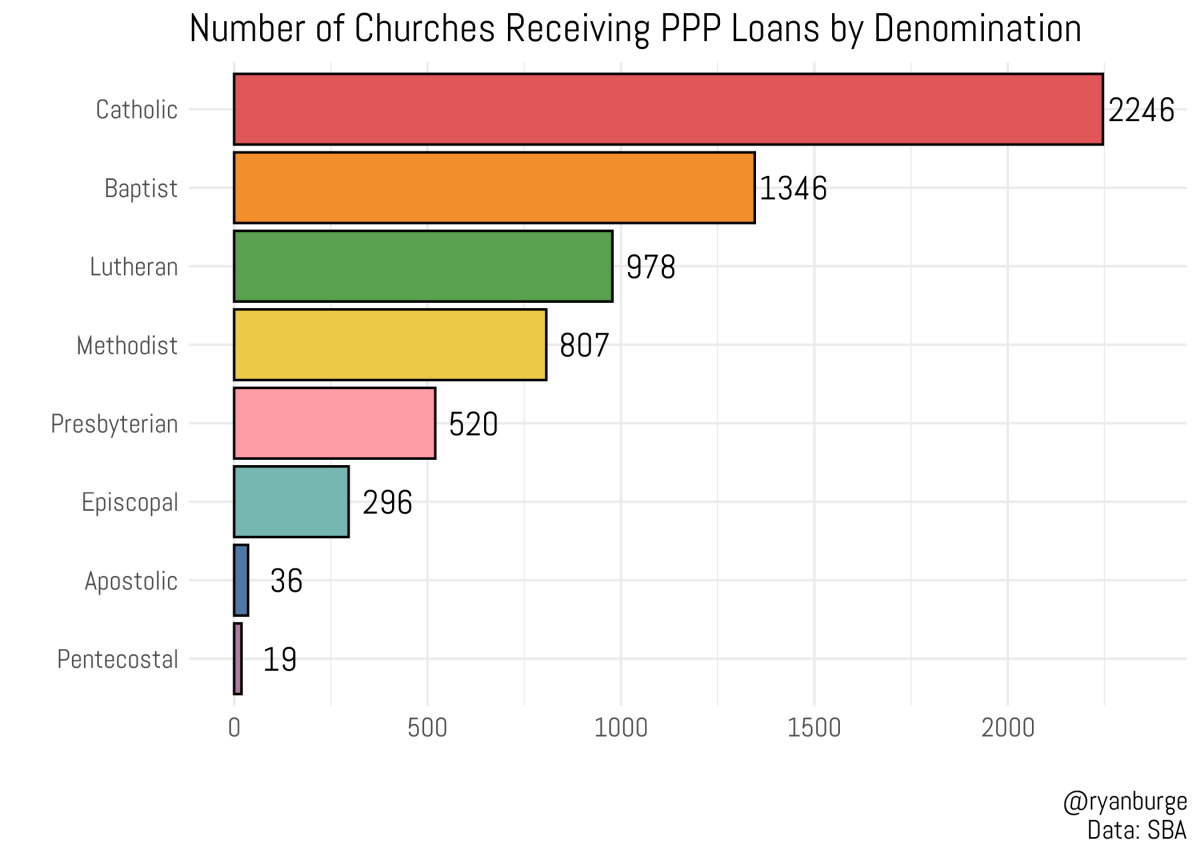

Of the churches whose names included denominational markers, Catholic and Baptist congregations were the most common beneficiaries. More than 2,000 Catholic churches received PPP loans, as did more than 1,000 Baptist churches. The rankings reflect Christian affiliation in the US—around 20 percent of the country is Catholic, while around 15 percent belongs to Baptist denominations (across evangelical, mainline, and historically black Protestant traditions), according to the Pew Research Center.

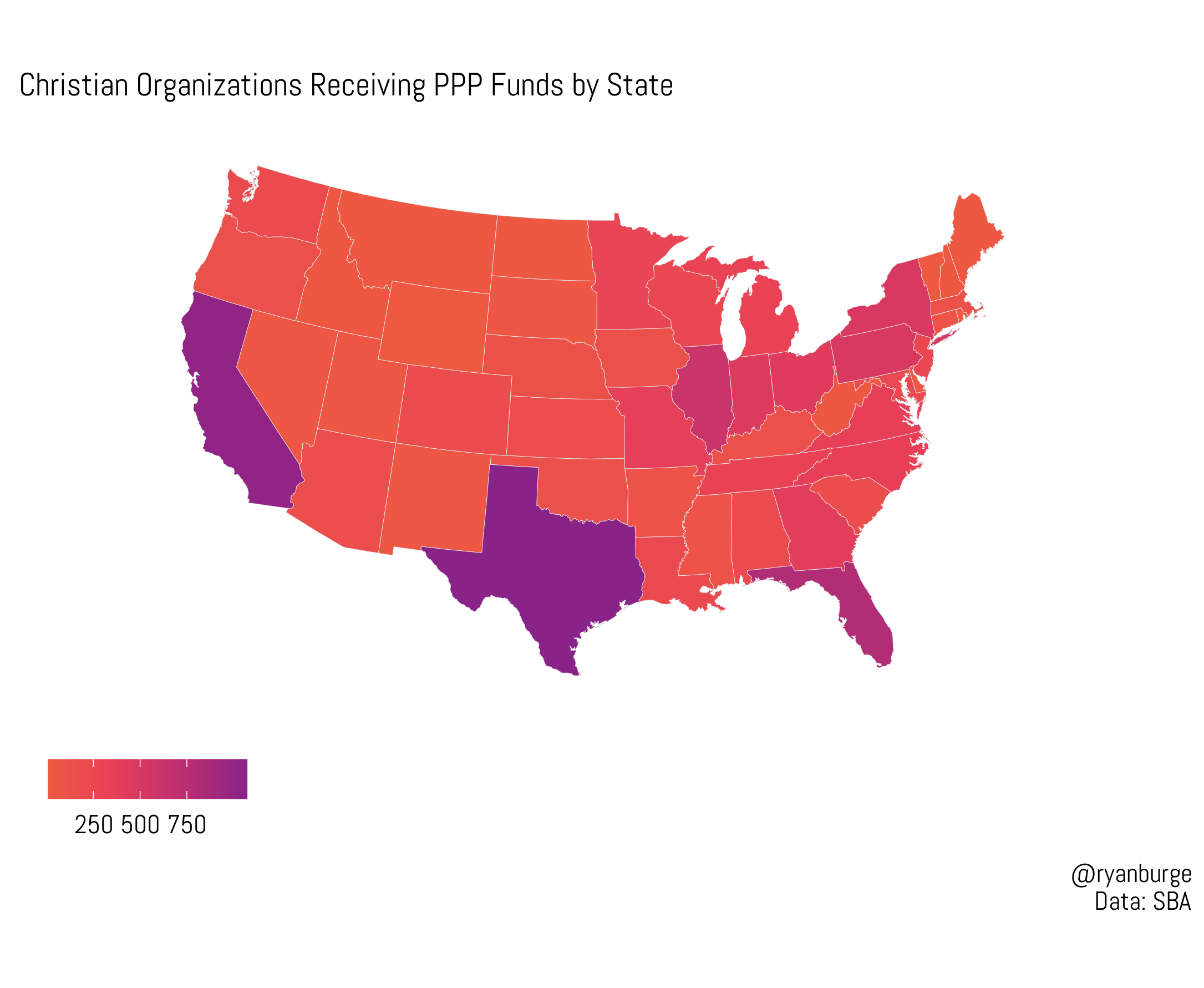

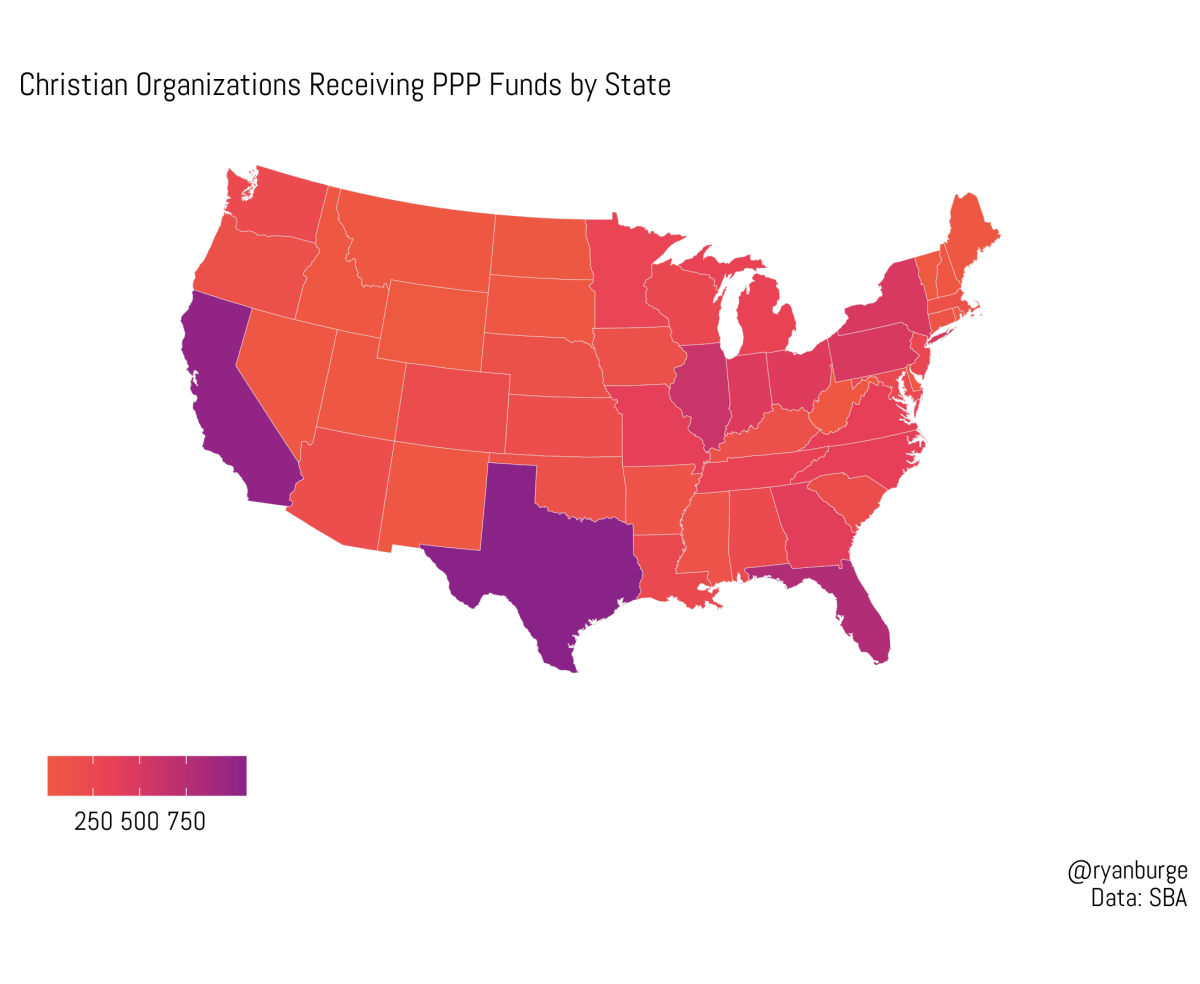

The most populous states saw the most religious organizations taking funds and the most jobs saved.

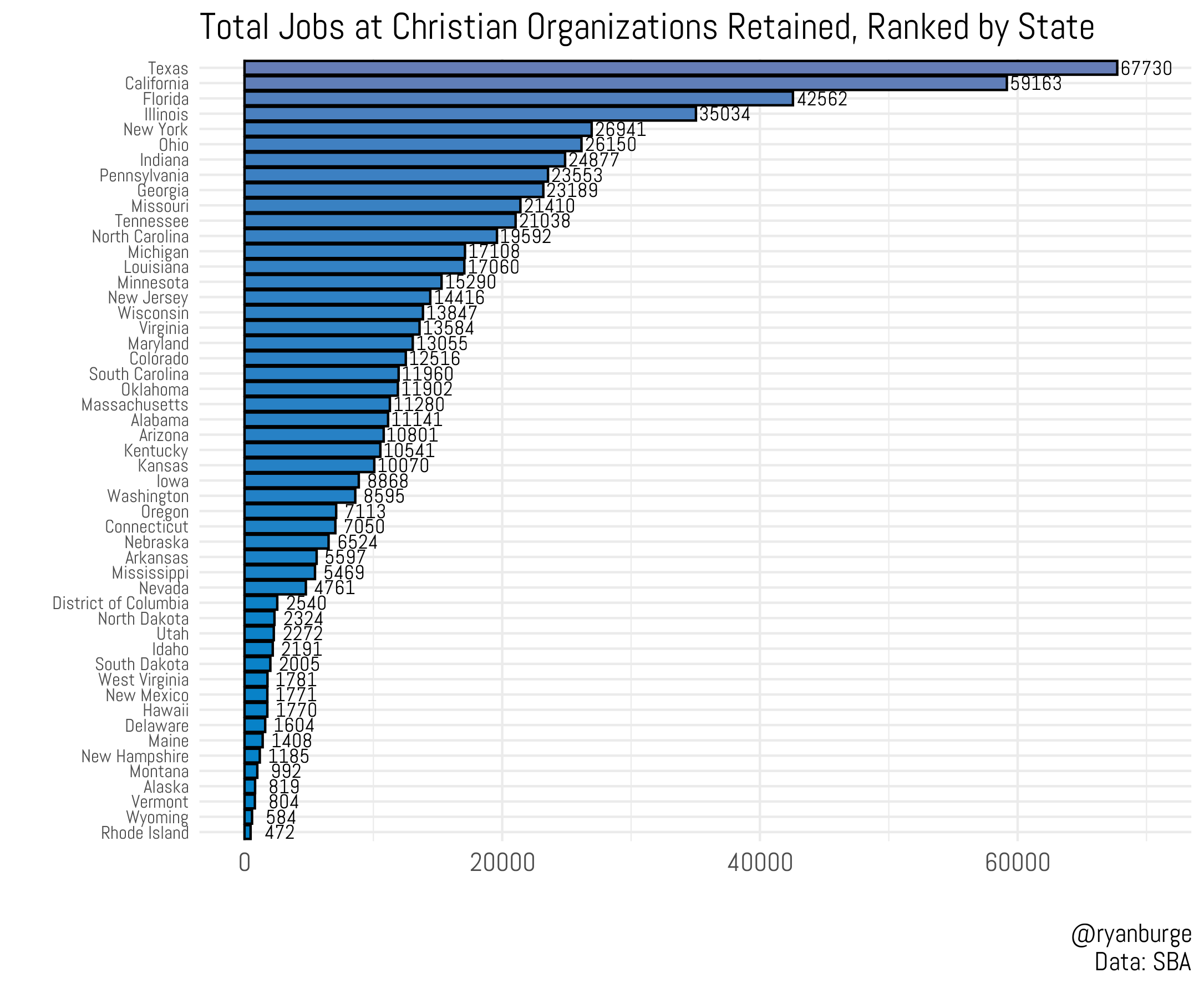

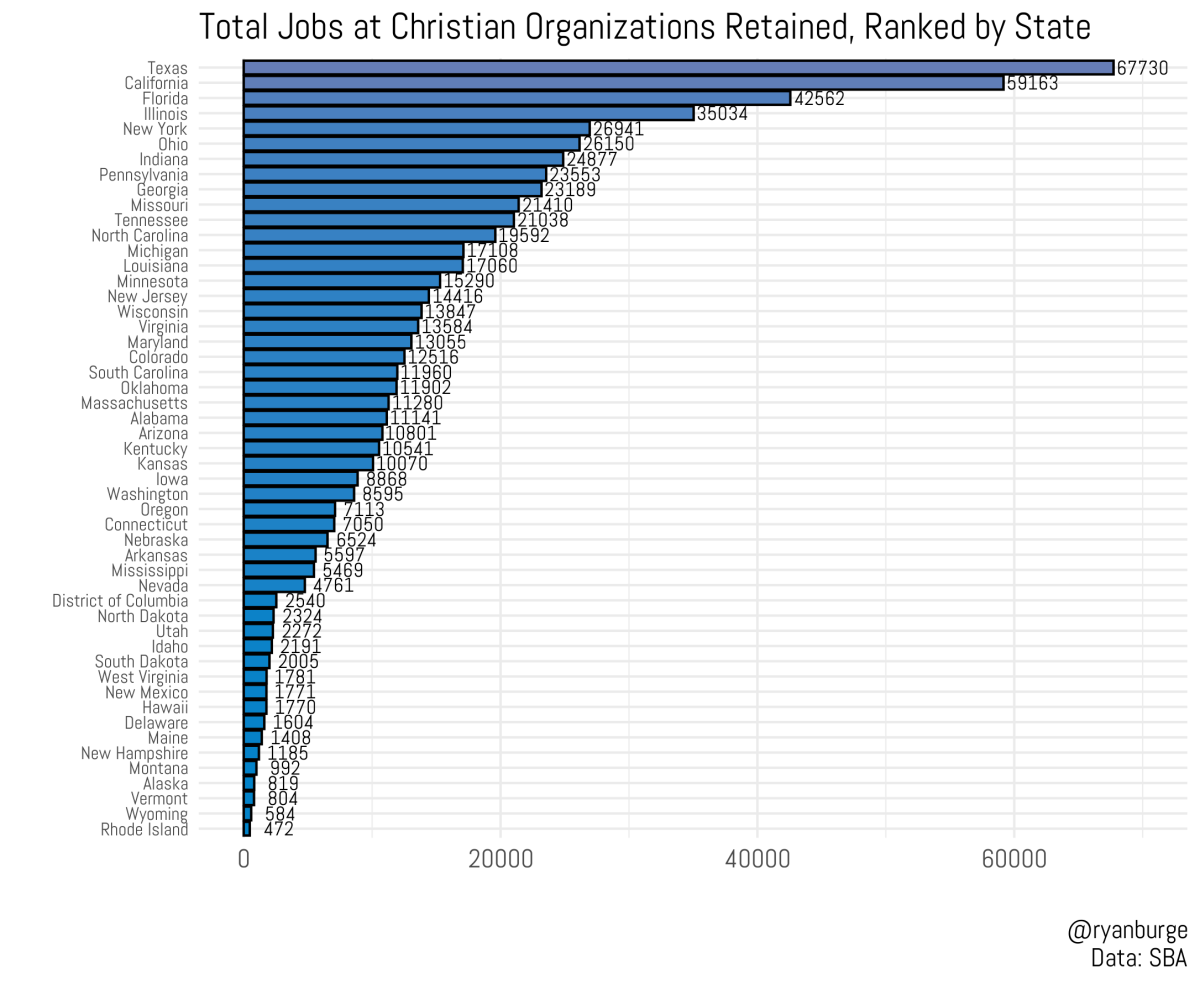

Texas had 1,072 Christian organizations that received PPP funds, and California was close behind at 1,025. Those recipients indicated the funds were used to retain nearly 70,000 jobs in Texas and nearly 60,000 in California.

Among the biggest Christian employers taking advantage of the stimulus opportunities in those states were Catholic Charities of San Francisco, which retained 500 jobs through the program, and First Baptist Church of Dallas, which recorded 293 jobs being saved through a loan of between $2 million and $5 million from the PPP.

Other large states followed, with Florida at 869 Christian organizations and Illinois at 643.

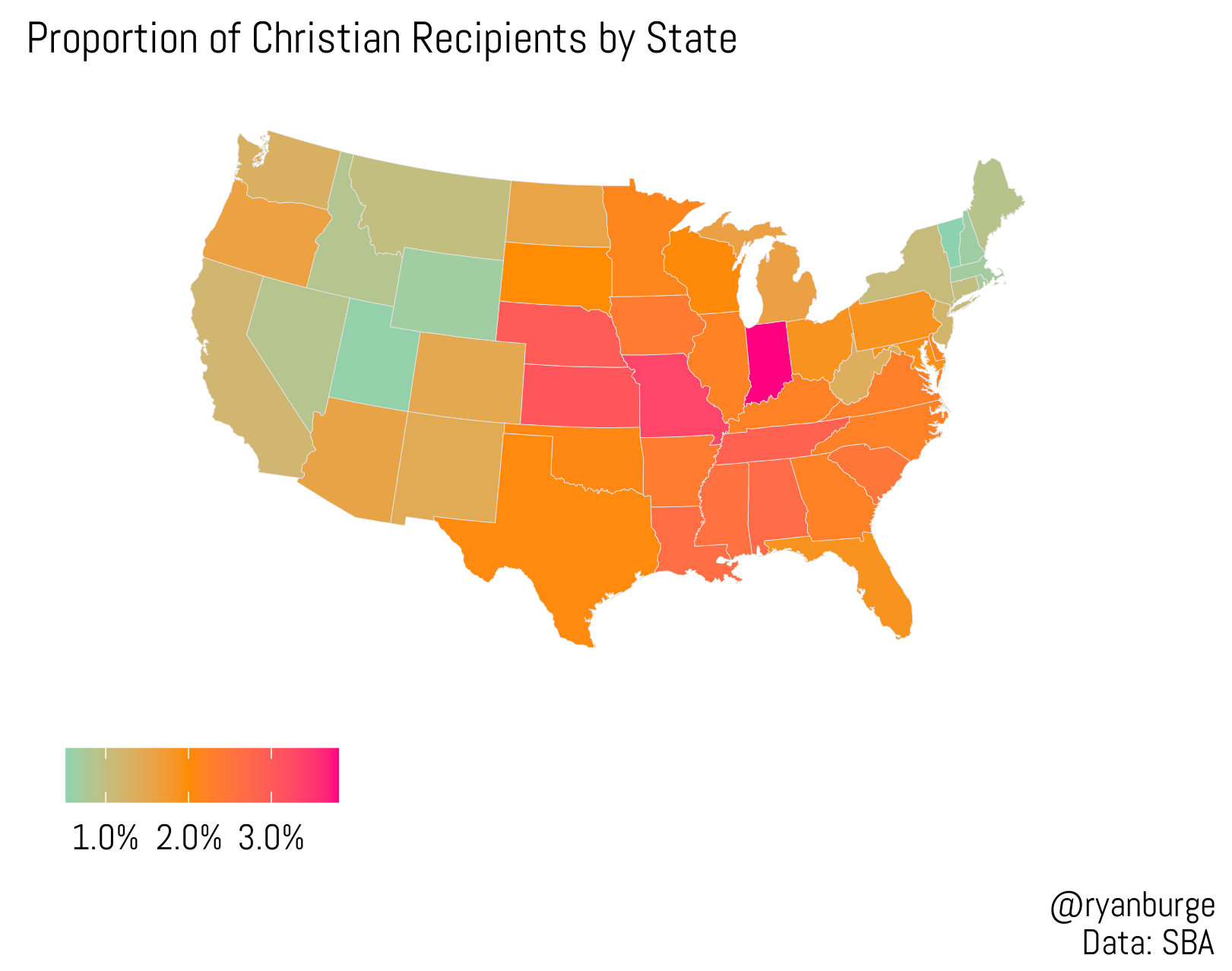

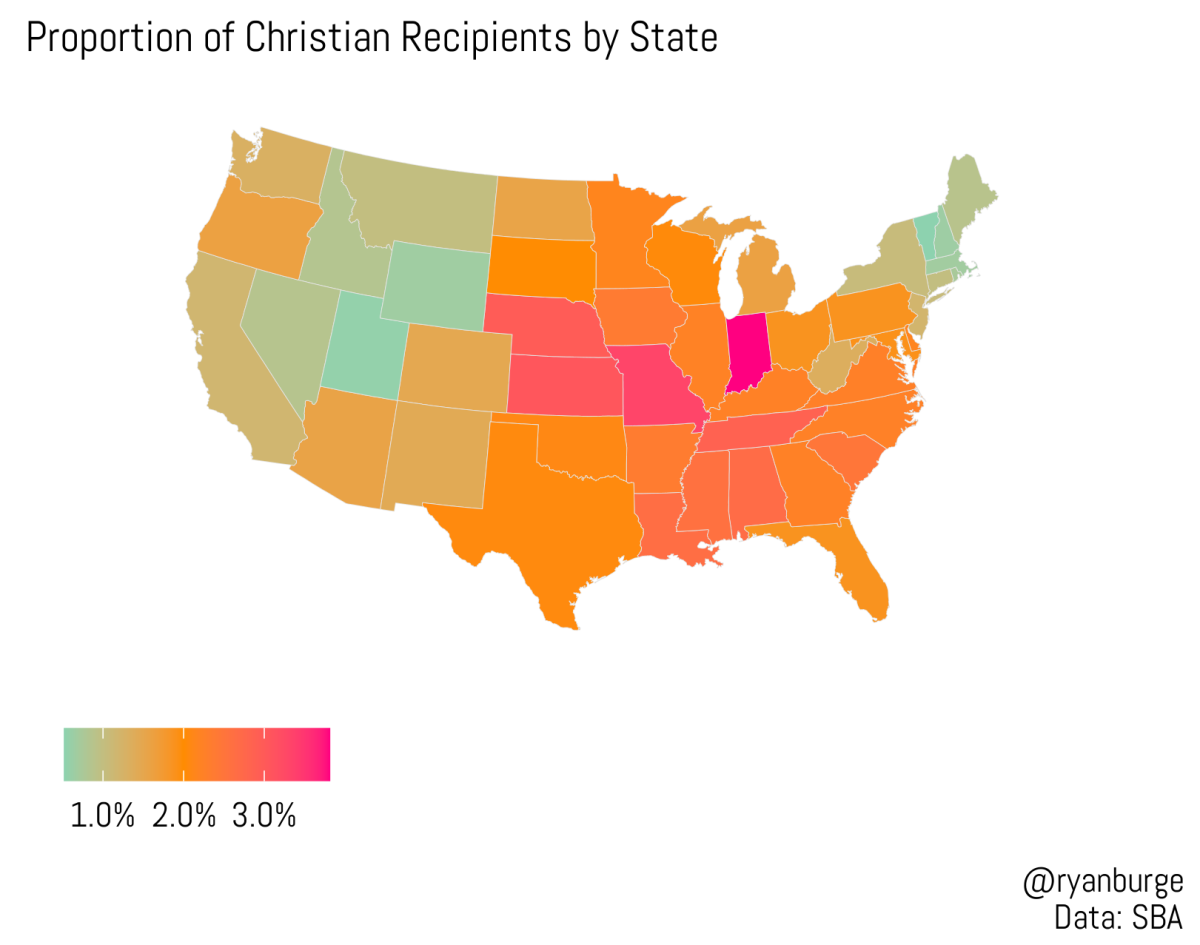

While the larger states had more ministries and churches receiving PPP dollars, the concentration of religious recipients was greatest in the Midwest.

Christian organizations in Missouri, Kansas, and Nebraska made up at least 3 percent of all PPP beneficiaries in the state, higher than the national average. Indiana had the highest concentration of religious recipients, with 4 percent. The state’s biggest PPP loan to a religious organization went to First Baptist Church of Hammond, Indiana, which was able to retain 322 employees with a loan of between $350,000 and $1 million.

In a majority of states, PPP funds preserved over 10,000 church and ministry jobs. Of the 665,000 Christian positions covered by the loans, nearly 20 percent were in Texas and California alone.

Although both states had between 1,000 and 1,100 Christian employers receive PPP funds over $150,000, Texas recipients represented an additional 8,500 jobs—perhaps a sign of the greater concentration of megachurches with large staffs located in the state.

Across industries, the PPP retained 31.4 million workers in organizations that received more than $150,000 in funds; those in Christian organizations represented 2.1 percent of all workers in this group. (Editor’s note: Christianity Today is a recipient of PPP funds.)

For many churches not meeting in person this April, May, and June (and not passing the offering plate), the PPP provided the monies necessary to pay staff and clergy, potentially heading off tens of thousands of people applying for unemployment benefits.

Yet there are some signs that churches and ministries’ initial financial concerns may have been overblown. A survey by the Evangelical Council for Financial Accountability found that by April, more than half of churches and Christian nonprofits reported that giving was back to pre-pandemic levels.

Christian camps and conferences as well as Christian schools remain most pessimistic about their financial future. Some Christian colleges have cited COVID-19 as a factor in recent faculty cuts.

Ryan P. Burge is an assistant professor of political science at Eastern Illinois University. His research appears on the site Religion in Public , and he tweets at @ryanburge .