Self-identified Christians in 30 states—from Alabama to Wyoming—say it’s a sin to lend money to someone who can’t afford to pay it back.

Most want the government to protect consumers from loans with excessive interest, although one in six Christians has taken out such a loan.

And more say their own experience (28%) rather than the Bible (9%) has informed how they see payday lending.

Those are among the findings of a new online survey of Christians’ views of payday lending from LifeWay Research. The Nashville-based research firm surveyed 1,000 self-identified Christians in 30 states, all of which have little or no regulation of payday loans.

Most Christians find payday loans impractical and morally questionable, said Scott McConnell, vice president of LifeWay Research. But many seem unaware that the Bible addresses lending practices.

“Ask people if charging high interest is wrong, and they’ll say yes,” McConnell said. “They forget the Bible calls it ‘usury’ and condemns it as sinful.”

The survey, conducted February 5 to 17, was sponsored by Faith for Just Lending, a national coalition of faith leaders opposed to predatory loans.

Among the key findings:

Christians are no strangers to payday loans. Overall, 17 percent of Christians have taken payday loans, including 20 percent of Protestants and 12 percent of Catholics. Half of African American Christians (49%) and a quarter of Hispanic Christians (24%) say they’ve taken out a payday loan.

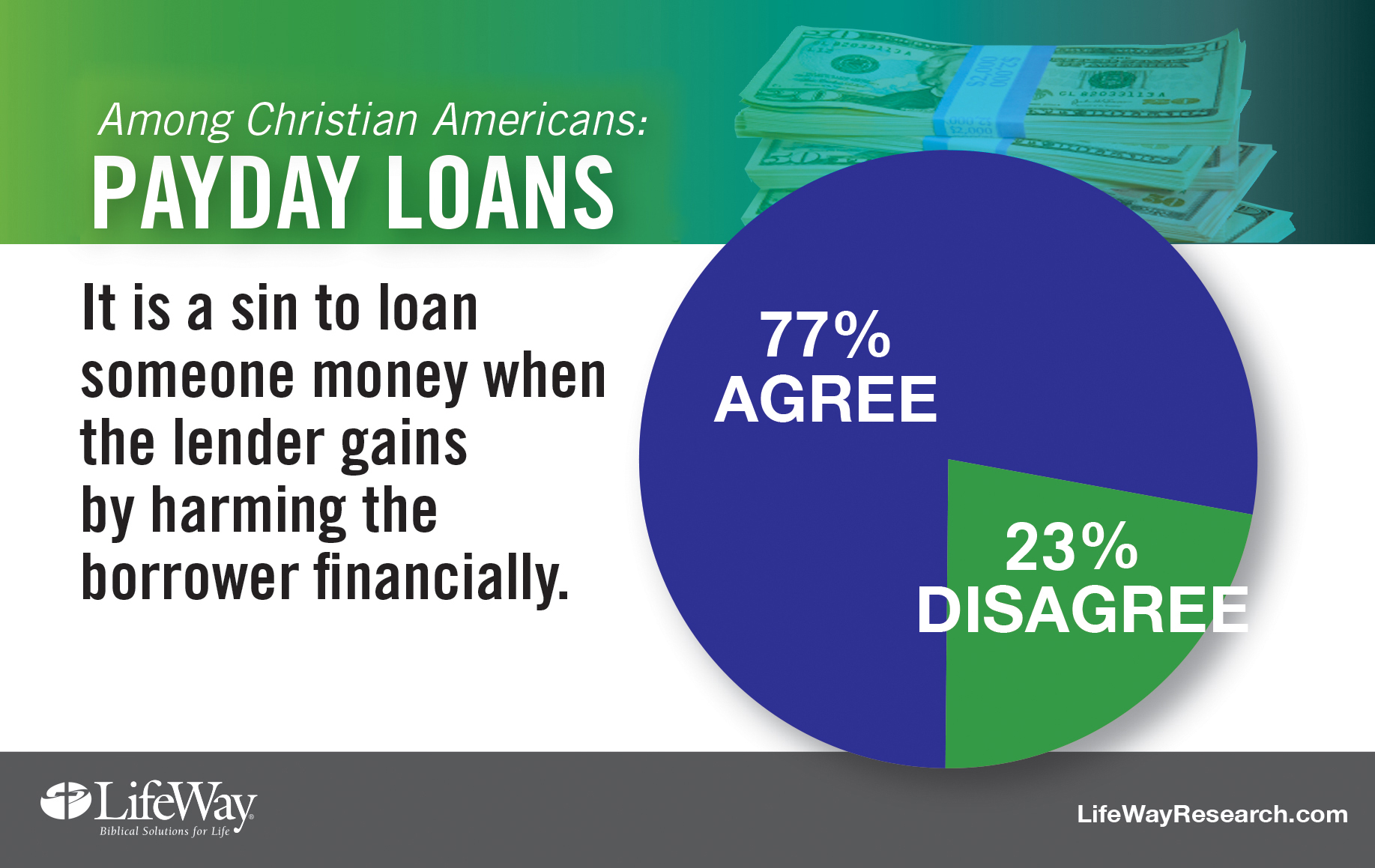

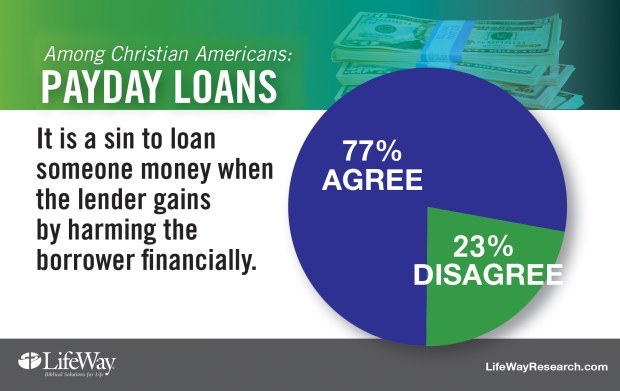

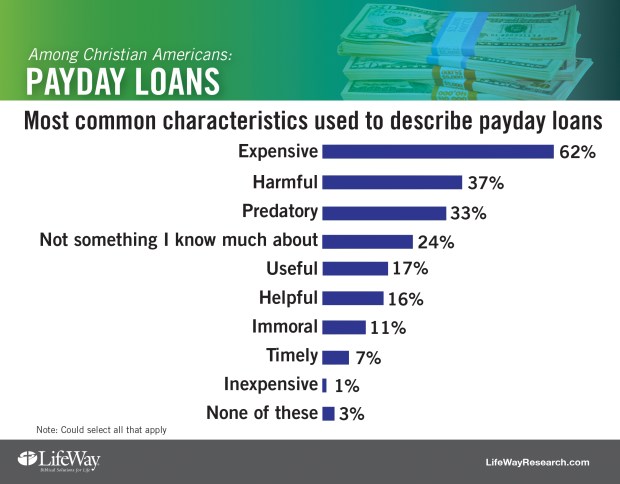

Most believe taking advantage of borrowers is sinful. But few say payday loans are immoral. Three-quarters (77%) of Christians say it’s sinful to lend money in a way that harms the borrower financially. They also describe payday loans as “expensive” (62%), “harmful” (37%), and “predatory” (33%). Still, more Christians say such loans are “helpful” (16%) than “immoral” (11%).

Maximum interest of 18 percent is enough. About half (55%) say the “maximum reasonable” annual percentage rate (APR) for loans should be 18 percent or less. That includes 37 percent who say APR should be capped at 12 percent interest or less, and another 18 percent who want to see a cap at 18 percent.

A typical two-week payday loan charges the equivalent APR of 400 percent, according to the Consumer Finance Protection Bureau (CFPB), a federal government agency tasked with consumer protection in the financial sector.

Few Christians see a connection between faith and fair lending. Nine percent say the Bible has the most influence on how they view lending practices. That’s less influence than the news media (14%), but more than churches (1%), politicians (1%), and national Christian leaders (less than 1%). Instead, Christians are most likely to rely on their personal experience with loans (28%), or say they haven’t given much thought to the fairness of lending practices (23%).

Most Christians believe the law should protect borrowers. More than four in five agree (86%) that “laws or regulations should prohibit lending at excessive interest rates.” Even more (94%) say lenders should only offer loans with reasonable interest, which can be repaid within the original loan period.

According to the CFPB, 4 out of 5 payday loans are rolled over for an extended time. In the LifeWay survey, 85 percent of Christians underestimated how often such loans are repeated.

Few Christians say their church has a plan to help those who turn to payday loans. Only six percent of Christians say their church offers “guidance or assistance related to payday loans.” One-third (34%) say their church offers no help, while 6 in 10 (61%) don’t know.

Protestants (7%) are more likely to say their church offers help than Catholics (2%). Those who have taken a payday loan (10%) are more likely to say their church offers help than those who haven’t (5%).

Editor’s note: CT’s new section, The Local Church, recently reported on one Texas church’s efforts to close payday loan storefronts in their community. The Garland, Texas, congregation has seen the local payday loan industry shrink by a third in recent months.

Christians say churches should give counseling about payday loans. More than half (56%) want to see their church offer guidance to those with financial needs, and a quarter (27%) want churches to give gifts or loans to those in a financial crisis. Christians are less interested in sermons about fair lending (17%) or advocacy (18%) for changes in laws or regulation.

Those who are interested in sermons about biblical principles for fair lending are most likely to be evangelicals (31%), African Americans (24%), or those who go to church once or more a week (24%).

Most Christians seem to want churches to offer a mixture of counseling and practical help, including 83 percent who agree churches “should teach and model responsible stewardship, offering help to neighbors in times of crisis.”

The Scriptures insist the poor be treated in a just manner, said Barrett Duke, vice president for policy of the Southern Baptist Convention’s Ethics and Religious Liberty Commission. That includes fair lending practices.

“Payday loans with their exorbitant interest rates operate far outside of what is ethical or biblical,” Duke said.

Galen Carey, vice president of government relations for the National Association of Evangelicals, said payday loans offer short-term solutions but create longer-term problems. Such loans, he said, have a “devastating effect” on churches and communities.

“A payday loan may look like an answer to prayer—a way out of a financial crisis,” Carey said. “But too often, payday or title loans lead to long-term indebtedness, making a small problem into a large problem.”

McConnell said churches can play a key role in helping those who are caught in a cycle of payday loans. After all, he said, there’s likely someone in most churches who has taken out a payday loan in a time of crisis.

“Anyone can encounter financial hardships,” he said. “The question is whether the destitute are met with support or someone intent on profiting from their situation.”

Bob Smietana is senior writer for Facts & Trends magazine.

Methodology:

The online survey of Americans in 30 states was conducted Feb. 5-17, 2016. The project was sponsored by Faith for Just Lending. A demographically balanced sample from a national online panel was used. This sample was screened to include only adults who describe themselves as having a Christian faith preference (Catholic, Orthodox, Protestant or nondenominational). Maximum quotas and slight weights were used for gender, region, age, ethnicity and education to more accurately reflect the U.S. adult population. The completed sample is 1,000 surveys. The sample provides 95 percent confidence that the sampling error does not exceed plus or minus 3.2 percent. Margins of error are higher in sub-groups.

Thirty states were selected by Faith for Just Lending because they do not have meaningful regulation on payday lending (this includes states listed in Payday Lending Abuses and Predatory Practices: The State of Lending in America & its Impact on U.S Households, Susanna Montezemolo, Sept. 2013, p. 24). The following states are included in the analysis: Alabama, Alaska, California, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Wisconsin and Wyoming.

LifeWay Research is a Nashville-based, evangelical research firm that specializes in surveys about faith in culture and matters that affect the church.

[Photo courtesy of Taber Andrew Bain – Flickr]