When my husband and I wanted to buy our first house in 2012, we ran into a problem: Neither of us had a credit history. We both came from families with a typical evangelical wariness of debt, and so we’d gotten all the way through college and marriage without a single loan payment between us. We’d earned scholarships and gone to cheaper schools, hosted a cookout for our wedding reception, and squirreled away cash to buy used cars.

“The borrower is slave to the lender” (Prov. 22:7), my mother had often warned. But declining to take on debt also made sense to me at a personal level. I have all the skepticism of complex financial systems you’d expect in someone who finished college during the Great Recession. I dislike the feeling of obligation and limitation debt can entail (Prov. 22:26–27). With a few exceptions like mortgages and some business loans, I associated accumulation of debt with poor stewardship and lack of self-discipline. Having no debt felt right and responsible.

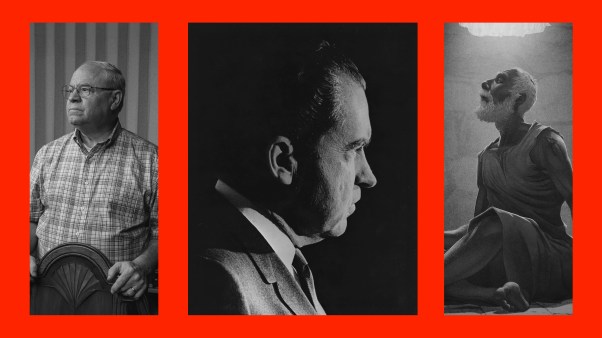

Like many evangelicals, that attitude easily mapped onto my politics. The US national debt was around $15 trillion in 2012, one year after the debt ceiling drama of 2011. If you’d asked me then, I’d have described that debt just as ethicist David P. Gushee did for CT in 2014. It’s “immoral and unwise,” he argued, even citing my mom’s favorite debt proverb:

Certainly, the Bible regularly calls for generous lending and debt forgiveness. But when it speaks of borrowing, the Bible is negative, and not just when addressing individuals. Borrowing is emblematic of national weakness that invites subservience to creditors (Deut. 15:6; 28:12). Borrowing for short-term needs risks long-term decline and even enslavement (Neh. 5:3–5). Creditors gain power over debtors (Prov. 22:7), though the powerlessness may not be visible until later. We Americans are feasting with borrowed money. We risk becoming a beggar nation.

I found that final point—that our borrowing would eventually be ruinous, if not for us then for our descendants—especially compelling. How could so much debt not take its toll? This kind of warning, of which there were many back then, struck me as self-evidently correct.

But $15 trillion in borrowing came and went, and then $20 trillion, and $25 trillion, and now the national debt is sitting at $31 trillion. That works out to about $94,000 per US citizen, $247,000 per taxpayer (a little less than half of the average American’s lifetime income tax payments), and a record-high 134 percent of GDP.

As the debt spiked ever higher, warnings of debt-induced crisis never stopped. Yet the crisis never materialized. The piper never seems to get paid. Is that because—as voices from the typically left-leaning modern monetary theorists to the late Rush Limbaugh have argued—there is no piper? Were the warnings always wrong?

That’s once again a pressing question, because we’re in another debt ceiling drama this spring. In late January, the federal government reached the legal cap on how much money Washington can borrow through the sale of Treasury bonds to make up the annual deficit, which is the difference between tax revenues and expenditures in a given year.

Though the Treasury Department can delay a federal debt default using “extraordinary measures”—accounting maneuvers to keep paying the government’s bills in the short term—those tactics can only buy so much time. But as the default deadline of June 1 fast approaches, the Biden administration and Congress are feeling the pinch to reach a dea—and fast.

Though some congressional Republicans are pushing to keep the debt ceiling at status quo, they don’t have the numbers to get what they want. Nor do Democratic lawmakers who want to get rid of the debt ceiling altogether—and anyway, president Joe Biden nixed that idea months ago, calling it “irresponsible.” (His administration is now reportedly reconsidering that conclusion, but it remains unclear whether Biden would take this option even if his legal advisers offer it.)

Realistically, the final deal will likely keep and raise the debt limit. The outstanding question is whether it will also cut federal spending to decrease or even reverse federal accumulation of debt going forward (as GOP leaders prefer) or if it will be a “clean” deal with no spending cuts (as Biden would like). Either way, a post-deal Washington will still have an unfathomably large debt. Should we be looking for the piper?

It’s not wrong to anticipate serious consequences for this level of borrowing, Romina Boccia, director of budget and entitlement policy at the libertarian Cato Institute, told me via email. But she warns that “a future U.S. fiscal crisis have been misunderstood.”

The danger is not so much an inflation so bad you might use bills as wallpaper. It’s rather a drift “toward more of a Japanese-style stagnation,” Boccia told me, and perhaps “a sudden, unexpected fiscal crisis during which interest rates would rise steeply.”

In that latter scenario, high interest rates would hit ordinary Americans trying to get mortgages and other loans, and they’d force the federal government to devote a far higher portion of tax revenues to debt payments to avoid loss of confidence in Treasury bonds or the dollar itself.

Louise Sheiner, an economist who’s worked at the Federal Reserve and US Treasury and is now with the Brookings Institution, didn’t anticipate quite such a drastic consequence in our phone interview. Some have warned that a loss of confidence would mean “no one’s going to lend to us,” she acknowledged. But the US had no difficulty borrowing throughout the pandemic at incredibly high rates. People still see Treasury bonds as good investments, even at the $31-trillion mark, Sheiner said. “We’re always able to pay them back.”

That’s not to say there’s zero risk of unwanted outcomes here, Sheiner continued, but she believes those consequences are mostly related to a rise in interest rates that would affect the whole economy, including both consumer and federal borrowing. This serious yet relatively mundane effect would require lawmakers to make the difficult choices they’re avoiding while low interest rates keep debt payments relatively affordable.

A spike in interest rates isn’t the only crisis economists envision coming from too much national debt. The modern-monetary-theory crowd contends inflation is the real concern and deficits don’t matter unless they’re causing inflation to rise too much. Across the board, though—whether we fear interest hikes or inflation or not, believe loss of confidence in US bonds and dollars is a real risk or not, want spending cuts now or later—there’s one consistent theme here: uncertainty about the future.

“We keep adding to the debt, and at some point, that is going to cause issues in the economy,” Sheiner told me, “but we don’t know what that point is. No one knows what that point is.” But, she said, “we care about the debt because we care about the future,” which requires us to think past the next decade, past the next election, past this deadline in June.

On this point, Boccia agreed, noting that the policy changes we would need for Washington to stop spending at a deficit “can take decades to produce significant savings,” and the kind of “prudent policy foresight” we’d need to adopt those changes now is in short supply.

We should be considering our children’s children and the impact on future society, not just the present moment (Prov. 13:22). Unfortunately, it appears more likely that we will stay in our ways and “pay the penalty” (Prov. 22:3). But it shouldn’t take a default deadline for us to think long-term.