In this series

While the multi-million dollar tally of Giving Tuesday donations will take time to compile, we already know which kinds of charities are most favored by American evangelicals.

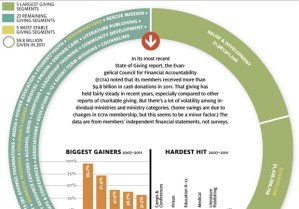

Giving continues to rise for many categories of ministry, according to new research released today by the Evangelical Council for Financial Accountability (ECFA).

An analysis of the finances of more than 1,800 of its accredited members found a 2.2 percent rise in cash contributions from 2015 to 2016 (the latest year available). This group also saw a 3.6 percent rise in non-cash giving, which includes income such as government grants or real estate.

That adds up to $16.2 billion of giving—$12.6 billion in cash and $3.6 billion in non-cash—to evangelical ministries in 2016.

“We are encouraged to see donations to our member organizations continuing to increase each year,” stated Dan Busby, ECFA president and CEO. “Members of ECFA are doing wonderful work to serve people in need in myriad ways, and donations made to these ministries are being used to make the world a better place.”

ECFA itself has also been growing, from 1,600 members in 2011 to almost 2,200 today. (Recently accredited ministries were left out of the year-to-year analysis, which relies on mostly audited financial statements.)

Only 5 of the 26 ministry categories tracked lost funding in 2016. Hardest hit were higher education (down 8.3%) and alcohol/drug rehabilitation (down 5.4%); the other three categories lost less than 3 percent. [The full table of ministries is at the bottom of this article.]

The biggest area of growth was in literature publishing and distribution, a category which has been hit hard in recent years. In 2016, Send the Light Distribution shut down after 40 years in business. In early 2017, Family Christian Stores followed, shutting down 240 stores and laying off more than 3,000 employees.

Perhaps in response to the high-profile plight of Family Christian, giving to literature publishing ratcheted up 13.2 percent from 2015 to 2016. The two previous years had been stagnant at best: From 2013 to 2014 giving was down 1.1 percent, and from 2014 to 2015 it was down 0.7 percent.

Adoption giving was also up from 2015 to 2016, this time by 11.4 percent. Except for a blip from 2012 to 2013 (growth of 3.9%), adoption giving has grown by more than 8 percent a year since ECFA started keeping track in 2010.

Despite the increased giving, domestic and international adoption numbers keep falling from their peak in the early to mid-2000s. Internationally, the drop-off can be traced largely to Russia (which banned American adoptions after the US called them out on human rights abuses), China (which both relaxed the one-child policy and began to promote domestic adoption), and Guatemala (which shut down their system in an attempt to clean up corruption).

ECFA said camps and conferences also saw about 10 percent growth last year, after jumping around for the past several years (down 9% in 2010, up 6% in 2012, up 19% in 2013, down 7% in 2014, and up 21% in 2015).

Giving to charities that offer donor-advised funds increased by 13 percent, “consistent with giving to donor-advised funds in general,” ECFA reported. Donor-advised funds let people give to charities while retaining the right to advise how those monies are spent—similar to setting up a private foundation, but without the maintenance cost and with extra tax incentives.

Contributions to donor-advised funds are at an all-time high, according to the National Philanthropic Trust. However, “the introduction of a tax reform bill in late 2017 continues uncertainty about tax policy changes that, if implemented, could reduce the tax benefits of giving to a donor-advised fund.”

The Republican tax plan currently being hashed out by Congress would raise the standard deduction so high that fewer givers would need to itemize their charitable deductions. Those 30 million Americans would no longer get a tax incentive to donate, which worries many evangelical leaders.

The concern isn’t so much that people will give less—though one study found it could drop donations by between $5 billion and $13 billion—but that it may be the first step to removing the charitable tax deduction altogether.

“It allows [opponents] to say, ‘We can get rid of this because most people don’t get the charitable deduction anyway,’” James Bakke, executive director of the Barnabas Foundation, told CT previously.

That would be both a financial and symbolic blow to government support for charities.

Instead, Christian leaders—such as those at the National Association of Evangelicals—are pushing for an expanded charitable tax benefit. One Republican senator—James Lankford, a Baptist from Oklahoma—agrees with them. He proposed a universal charitable deduction on top of the standard deduction.

“All Americans should be offered the same incentive and tax benefit to give for what they believe in,” he said, “not just the wealthy.”

Here is the complete ECFA analysis of changes in giving to evangelical ministries:

| Organizational Segment | 2015 to 2016 | 2014 to 2015 |

| Adoption | 11.4% | 8.4% |

| Alcohol/drug Rehabilitation | -5.4% | 13.1% |

| Associations | 5.5% | 6.3% |

| Bible Study | 4.9% | 2.8% |

| Camps and Conferences | 10.1% | 21.2% |

| Child Sponsorship | 4.5% | 7.0% |

| Children’s Homes and Orphan Care | 5.2% | 11.1% |

| Church: Denominations | 0.4% | 8.8% |

| Church: Local | 2.5% | 3.1% |

| Community Development | -2.6% | 11.7% |

| Education: Higher Education | -8.3% | 11.0% |

| Education: K-12 | 5.7% | 2.9% |

| Evangelism | 3.9% | 7.1% |

| Leadership Training | 6.0% | 5.0% |

| Literature Publishing | 13.2% | -0.7% |

| Media | 1.9% | 2.2% |

| Medical | 5.8% | 2.6% |

| Missions: International | 0.7% | 4.0% |

| Missions: Domestic | 2.0% | -0.3% |

| Missions: Short-term | -1.4% | 25.2% |

| Other | 0.8% | 20.8% |

| Pregnancy Resource Centers | 4.6% | 6.5% |

| Prison | 6.0% | 11.7% |

| Relief and Development | -1.2% | -13.8% |

| Rescue Missions | 0.8% | 3.6% |

| Student/Youth | 4.0% | 8.2% |

| Year-to-Year Change | 2.2% | 2.2% |

ECFA also noted changes in giving to large vs. small ministries:

| Annual Revenue | 2016 | 2015 |

| Under $1 million | -2.1% | -1.1% |

| $1 to $5 million | 2.4% | 6.5% |

| $5 to $10 million | 2.4% | 3.5% |

| $10 to $25 million | 2.6% | 4.1% |

| $25 to $50 million | 3.4% | 4.6% |

| Over $50 million | 1.7% | 0.7% |