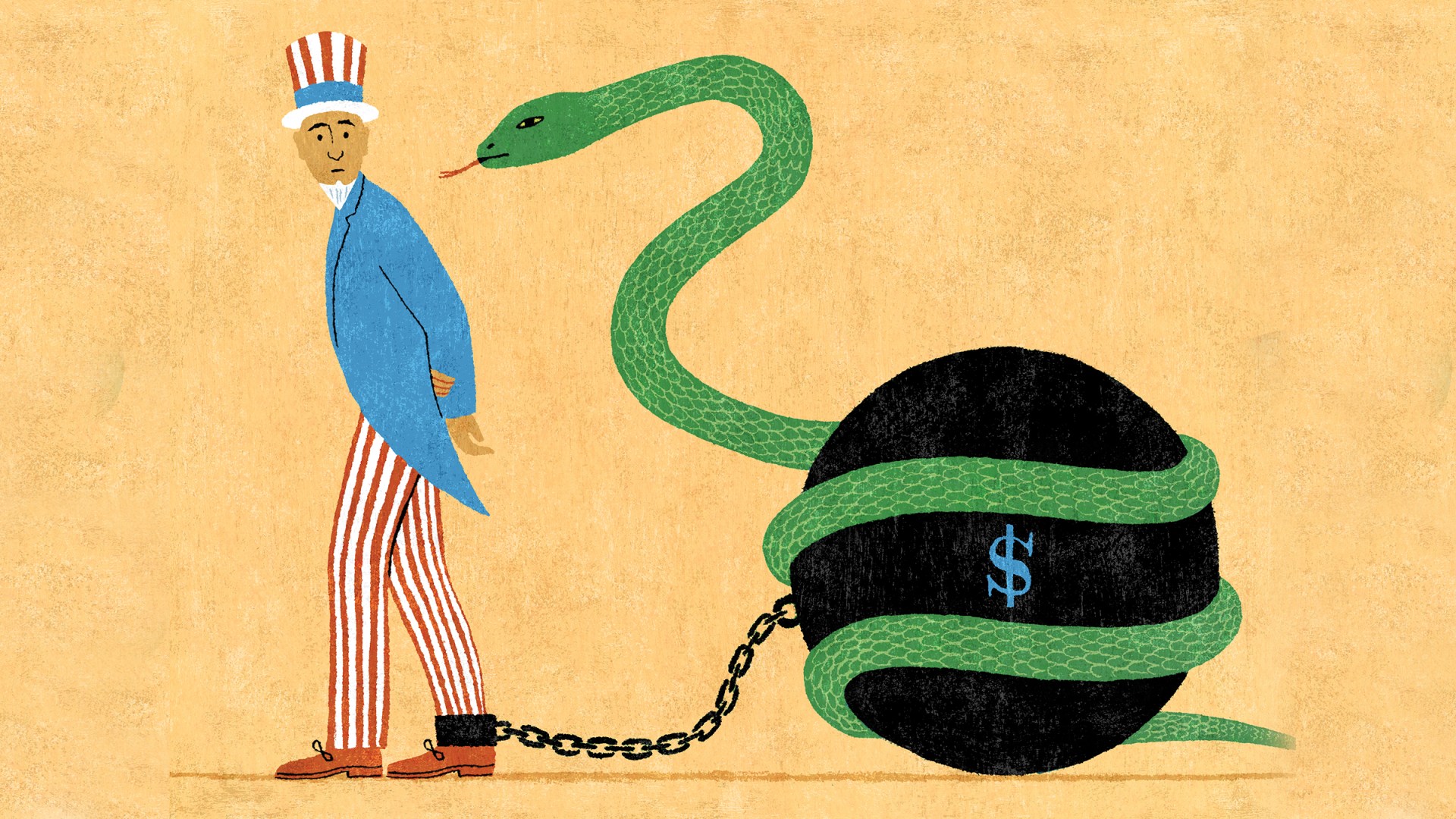

Immoral and Unwise

David P. Gushee

At the moment my fingers hit these keys, the U.S. government debt had reached $17.071 trillion, or $58,853 per citizen. Our debt to gross domestic product (GDP) ratio sat at 107 percent. Our credit rating had fallen to AA plus, with a negative outlook—the first time our rating has been downgraded. By all these measures, our country is falling behind Canada, Great Britain, Germany, and other peer nations.

Most progressive evangelicals who address government spending focus on compassion issues. They connect God's care for the poor to U.S. government spending priorities. This often seems to mean by default that all cuts to social welfare spending are bad, and that all increases are good.

I agree with my progressive evangelical allies that our government—which projects spending $3.77 trillion in fiscal 2014—seems to have sufficient resources to provide for the sick, the aged, the poor, and the uninsured. I agree with an overall reading of the Bible that prioritizes physical human needs over most other priorities. But I protest a too-easy move from "God cares for the poor and calls Christians to do the same" to "God wants the secular government of the United States to spend x on social welfare." Translating a sacred text into a political ethic is not that easy.

Still, we have a moral problem on our hands: While our nation budgets $3.77 trillion for spending in fiscal 2014, it forecasts revenue of $744 billion less than that. If a nation does that for long enough, it ends up with a debt of $17 trillion—and rising.

A government that develops a pattern of spending considerably more than it raises behaves immorally. But its immorality is not simply the immorality-as-immediate-hardheartedness-to-the-poor, so often decried by my friends.

In biblical terms, borrowing itself is problematic. Certainly, the Bible regularly calls for generous lending and debt forgiveness. But when it speaks of borrowing, the Bible is negative, and not just when addressing individuals.

Borrowing is emblematic of national weakness that invites subservience to creditors (Deut. 15:6; 28:12). Borrowing for short-term needs risks long-term decline and even enslavement (Neh. 5:3–5). Creditors gain power over debtors (Prov. 22:7), though the powerlessness may not be visible until later.

We Americans are feasting with borrowed money. We risk becoming a beggar nation. My father used to speak about the trouble people run into when they have "champagne tastes on a beer budget." That's us. We tax ourselves like a beer country and spend like a champagne country.

Christians of all political persuasions must call for fiscal responsibility from our government, in all budget categories, and accept the hard results when it comes to our favorite programs. The precise mix of budget cuts and revenue increases needed for a balanced budget is a political judgment. But this is the direction we need to go.

David P. Gushee, author of The Sacredness of Human Life, is director of the Center for Faith and Public Life at Mercer University in Atlanta.

Not So Immoral

Gary Moore

My deficit-despising tea party friends borrow to finance homes and businesses. Few of them would consider it immoral to finance life-saving surgery for a child. So why does borrowing suddenly become immoral when our government does it?

Partisanship by both parties causes Americans to judge Washington's extreme borrowing based on whether it funds our preferred causes. Those causes are what I call guns and butter.

The butter is health care for retirees and poor families, and it's a key concern at the moment. But historians estimate about one-half of our current federal debt is due to guns—in general, to waging war. There's a remarkable correlation between our country's wars and its debt. My friends who fret most about the debt seem the quickest to support the country going to war.

During the Clinton administration, defense spending fell, and federal deficits turned to surpluses. By the time President George W. Bush took office, The Economist projected we might have the entire federal debt paid off by 2013. Bush's considerable tax cuts and funding of two wars turned that projection into a false prophecy. The deficit spiked when Wall Street collapsed and the government increased deficit spending to goose the economy.

Despite our anxiety over the deficit, our economic picture is rosier than most realize. Washington's current annual deficit is much smaller than it was during the Great Recession. Our accumulated federal debt as a percentage of gross domestic product is one-half what it was at the end of World War II.

Half the federal debt is owed to Americans, who collect interest on U.S. Treasury securities. Total interest payments on the federal debt as a percentage of GDP are lower than during the Reagan years, when interest rates were much higher.

Economists at the International Monetary Fund, a frequent critic of excessive federal debt, recently estimated that the United States can handle another $10 trillion of debt.

We should always be prudent about debt, as the Bible commands. But other biblical concepts prompt us to rethink our unwillingness to share more butter. Paul taught us to fill our minds with "those things that are good and that deserve praise" (Phil. 4:8, GNT). This includes thinking about America's vast assets as well as its relatively modest liabilities. Moses taught, "The king is not to have a large number of horses for his army" (Deut. 17:16, GNT). But we spend as much as the rest of the world combined on defense.

America now has enormous economic inequality. But God told Moses that the Promised Land was to be distributed according to the relative size and needs of the tribes (Num. 26:54). In this way, socioeconomic equality was embedded in the very dna of Israel's agrarian economy. Moses encouraged trade, which led to inequality. But he prevented too much economic concentration by also instituting the concept of Jubilee, where all property was returned to its original owners every 50 years.

Gary Moore, author of six books on faith and finance, is a veteran of Wall Street finance and founder of FinancialSeminary.org.

Immoral as a Lifestyle

Amy E. Black

Policy analysts at leading think tanks across the ideological spectrum describe U.S. debt and budget woes as nearing "apocalypse," "catastrophic failure," and a "fiscal train wreck." When a range of experts who rarely agree on anything reach consensus, we should take notice.

Accruing debt itself is not immoral, but a culture of debt most certainly is. Debt has become the American way of life, one that threatens our flourishing and that of future generations. In our personal lives, we make daily budget decisions. Many choose to take on debt for expensive items deemed worthy investments or necessities—the purchase of a home, replacing a leaky roof, loans to defray the expense of college tuition. Such borrowing seems prudent. On the other hand, many Americans accrue debt to artificially maintain an extravagant lifestyle or accumulate beyond what they can ever repay. Such practices violate the principle of wise stewardship.

The same logic applies to lawmakers and the economic decisions they make. Most economists agree that deficits arising during downturns can help stabilize the economy. But government budgeting in recent years has been reckless. Most economists also agree that continued deficit spending in good times can stifle growth and negatively affect credit markets.

Too often, however, lawmakers overlook sound economic principles in favor of political expediency. They find it easiest to expand spending without raising revenues. They avoid scrutinizing current programs and policies to see what is truly essential. Instead, they simply borrow more.

Our collective unwillingness to make hard decisions and accept shared sacrifice burdens future generations. Annual deficits of more than $1 trillion a year, the national debt exceeding $17 trillion and continuing to grow, and the exponential rise of entitlement spending have created an unsustainable future for us, our children, and our grandchildren.

Both Democrats and Republicans have contributed to the problem. Instead of wasting time and energy casting blame, lawmakers should come together to solve the crisis. Ignoring complex political problems does not make them disappear.

The path Christians should encourage starts with the biblical principles of wise stewardship and shared sacrifice. We must seek justice and give special concern for society's most vulnerable members. Government programs and services benefit us all and help secure the common good, and we all have an interest in maintaining a stable and well-functioning system.

Given the current budget realities, however, we will need to make sacrifices to ensure future stability. The current situation is called a crisis, and rightly so. It is a sign of moral failure that we continue practices that almost everyone—left, right, and center—agrees are unsustainable. Our nation's leaders must find the political will to address the burgeoning debt with meaningful and substantive reform. And we should applaud their courage and willingly share the burden.

Amy E. Black, author of Honoring God in Red or Blue, is associate professor of political science at Wheaton College (Illinois).