CHRISTIANITY TODAY/September 22, 1989

Rising tuition and easy loans send students into debt—and away from the mission field.

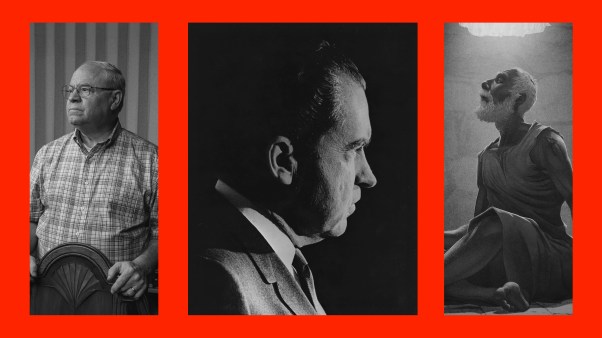

Mike Pollard is typical of an unknown number of students with a desire to serve on the mission field—and a college debt standing in the way. Pollard was on his own paying for school, and though he worked throughout his four years at a Christian college, the jobs he held fell far short of paying enough to cover his expenses. Upon graduating in 1985, he owed almost $20,000, most of it in student loans for tuition.

In spite of his willingness to go, Pollard knew no mission board would accept him for an overseas assignment with that amount of debt. So rather than face the decision about which mission agency to apply to, he faced another difficult choice. “Should I take a lower-paying ministry job that will take me longer [to pay off my debt and] get to the field,” he said, “or should I get something in the secular sector and pay it off more quickly?”

His desire to stay actively involved in missions work won out, and Pollard, 26, now works as a copy writer for the Association of Church Missions Committees (ACMC). He is paying off his student loans on schedule—“$116.77 a month,” with about six years to go on the largest one. “I know the number well,” he said. “I write it out every month.”

Though statistics are virtually nonexistent, missions recruiters, school officials, church pastors, and students agree almost unanimously that school debt presents a significant and growing obstacle to potential missionaries.

“We really don’t know the full magnitude of the problem, because many young people, knowing the [no-debt] policy of the missions, simply never apply in view of the debt they have,” said Wade Coggins, executive director of the Evangelical Foreign Missions Association. He raised his concern recently in an article in the Evangelical Missions Quarterly, prompted by a conversation he had with a couple in his church who had put their missionary plans on hold because of school debt.

One rough measure of the extent of the problem is found in a survey of students from Urbana 87, the triennial missions conference sponsored by InterVarsity Christian Fellowship. A follow-up mailing that asked 300 of the conference’s 18,700 participants what obstacles they faced in reaching the mission field found that nearly one-third cited concern over finances, said Dan Harrison, director of Urbana 90. About half of those, or 15 percent overall, specifically mentioned debt.

Learn Now, Pay Later

The surge in college costs in the past decade has clearly driven more students to loan-application forms. Increases in tuition and fees continue to rise at rates above inflation. A recently released college board survey indicated a 5-to 9-percent rise this fall (a moderate increase compared to the double-digit increases of the early 1980s).

Private Christian colleges—traditionally the source of a majority of missionaries—have seen tuition increase at similar and often higher rates (see “The Price of Learning,” p. 37). So Christian college students, like their counterparts in other schools, are going into debt to finance their education.

Almost $10 billion annually is borrowed by students across the country through a variety of government-backed programs. The Guaranteed Student Loan (GSL) program (now known as the Stafford loan) is the largest. Through it as much as $13,000 may be available, based on need, to a student. Repayment is deferred until after graduation; then a schedule of payments may stretch for up to ten years at 8-to 10-percent interest.

A variety of other loans is also available from state programs and the colleges themselves for undergraduate and graduate students.

Few schools compile exact figures on the debt loads of their students, but financial-aid officers at several Christian colleges contacted by CHRISTIANITY TODAY estimated that about one-third to one-half of their graduates receive some form of need-based financial aid. Their average loan debt was about $8,000 to $9,000 dollars upon graduation, close to the national average.

However, debts of $ 15,000 to $20,000, like Pollard’s, are not unheard of. Students relying on loans to complete graduate as well as undergraduate studies can amass even more. And it is not uncommon for potential missionary couples to have financed two educations by student loans and owe in excess of $30,000.

Pay Or Stay

But the deficit-spending pattern of the eighties runs head-first into long-standing financial policies of mission agencies. Most have strict no-debt policies for their overseas career candidates. (Short-term projects usually do not carry such restrictions.) And while some organizations may allow a candidate with debt to get to the field, salaries or support levels seldom leave much room in a household budget for debt payments.

Africa Inland Mission (AIM), for example, puts limits of $50 per month on singles, $100 per month on couples for debt payments, and will not allow candidates to raise extra support to cover those amounts.

Ironically, many mission agencies require a significant number of credit hours in Bible courses, which usually must come from a Christian college, Bible college, or seminary—private institutions where tuition costs generally run higher than at state schools. For the growing number of missions recruits from secular schools, that means at least a year in some further study. Even Pollard, though he attended a Christian college, said he would need additional credits in Bible to supplement his communications major. (He hopes to start further study next year, and he is adamant about not borrowing to do so.)

Graduate degrees are also increasingly being required for missions work, to enable missionaries to meet both visa requirements and the needs of the national churches served. In addition, mission organizations may also require two or three years experience in a church or a home mission field after graduation. Such jobs, EFMA’s Coggins points out, seldom pay enough to retire debts quickly.

The result is that many potential missionaries must delay the start of their service. Indeed, mission agencies report the average age of their candidates has risen. For example, men and women attending TEAM’s candidate school are now about 33 years old, compared with 26 or 27 a decade ago, said Doris Frazer, assistant candidate secretary.

There are positive aspects to the delay. According to missions recruiters, students who often have not been active in a local church during their school years learn what involvement in a congregation is like. And they develop responsible work habits that can benefit them on the mission field. Agencies who traditionally have sent older workers enjoy low resignation rates (often less than 3 percent).

But while the delay can produce more mature candidates for the field, it can also hinder them from arriving at all. Again, no statistics are available, but conventional wisdom among missions recruiters holds that the longer it takes after graduation to get a potential missionary into service, the less likely the prospect will make it to the field, especially when marriage and children enter the picture.

“Getting involved in the workaday world exposes students to what it takes to earn a day’s pay,” an appreciation not always found in missionaries who go straight from school to the field, said Forrest Zander of Wycliffe Bible Translators’ Chicago regional office. “On the other side, one can easily get swept up into the materialistic views, and get used to a regular paycheck every two weeks. That makes it harder to live by faith.”

Searching For Solutions

While awareness of the problem may be growing, working solutions are hard to find. Debt counseling, required by the government for federally guaranteed loans, often amounts only to a half-hour group session explaining conditions of the loans. But some school loan officers, like Vicki Clark at Columbia Bible College, are taking more time with students and studying the implications of borrowing.

“This is a generation used to plastic, used to borrowing and being in debt,” she said. “I want them to know that heavy involvement with student loans could hinder their plans to do what they believe God wants them to do.”

Scholarships and special funds for missionary education are available at most schools, but most fall far short of paying for an entire education.

One exception is the Billy Graham Center at Wheaton College, where one endowed fund will repay 25 percent of a student’s debt for each year of service on a foreign mission field.

Though no one argues the wisdom of overseas missionaries being debt free, some agencies are making their policies more flexible. In response to the problem, Campus Crusade for Christ, for example, sets relatively high limits on debt amount (up to $10,000 per person for education debt, with payment limits of $200 per month for singles and $250 for couples) and allows staff members to raise additional support to cover their payments.

Most in the missions community look to help from local churches. In fact, many larger churches are already helping students who indicate a serious interest in missions.

At Elmbrook Church near Milwaukee, a missions-committee fund provides up to $1,000 per year for each student from the church headed for missions. If a student does not enter missions work within a reasonable time after graduation, he or she is asked to repay the money with interest. Since about 1982, the fund has helped 25 students complete undergraduate and graduate studies, according to missions pastor Valgene Hayworth. In that time, only two have not gone to the mission field.

Smaller churches that cannot match Elmbrook’s million-dollar missions budget can still contribute to a potential missionary’s success, according to Floyd Bruning of the ACMC. “The key is for churches to assume responsibility early in the process, long before someone becomes a candidate, and find ways to keep them out of debt in the first place.”

While the problem of debt will not go away in the next few years, it is not likely to lead to an emergency shortage of missionaries serving overseas, said Coggins.

The question that remains, he said, is whether missions, schools, and churches will find creative, cooperative means to make use of all the human resources ready and willing to go.

In the end, debt—like other obstacles to missionary service—measures the depth of commitment of those who would serve, said Wycliffe’s Zander. “If they have determined that God has called them, they’re going to get there, no matter what the cost.”

By Ken Sidey

The Price of Learning

Christian institutions have not escaped the rapid rise of tuition during the 1980s. Almost all American Bible colleges, Christian liberal arts colleges, and evangelical seminaries are “tuition driven.” Lacking significant endowments, they generally derive more than 50 percent (often as much as 70 or 80 percent) of their budgets from student fees.

Tuition and other costs vary, depending on the type of school providing the education:

• Figures provided by the Christian College Coalition show the mean amount of tuition and fees among 74 of its member schools for the 1988–89 school year was $5,856. In 1984–85, the figure was $4,422.

• A sampling of ten evangelical seminaries contacted by CHRISTIANITY TODAY shows the average amount of tuition and fees for a three-year master of divinity program was about $4,640 per year for 1989–90. In 1984–85, the figure was about $3,060.

• According to the American Association of Bible Colleges, tuition, fees, and room and board among its approximately 110 members averaged $4,786 last year. (Figures for previous years were not available.)

• The College Board reports the average tuition and fees at all four-year private institutions this fall is about $9,000 per year. At state universities, attended by 80 percent of all college students, tuition and fees average $1,700 per year.